- Wells Fargo Check Deposit Online

- Wells Fargo Check Deposit Atm

- Wells Fargo Check Deposit Policy

- Wells Fargo Check Deposit Max

Even in an increasingly digital world, checks can still be part of everyday finances for many people. Some people may receive checks frequently, such as their paycheck, while others receive them only occasionally. The deposit of paper checks is handled differently than direct deposits, which are electronically deposited into your account. Here are answers to some common questions about check deposits.

When can I spend the money from a check I have deposited?

- And balance a deposit, and second company user to approve that same deposit before transmitting it to the bank – A deposit approver is an internal approver within your group, not an approver at the bank (you can have multiple deposit approvers) – If you request the deposit approver role, it applies at the account-level (all deposits.

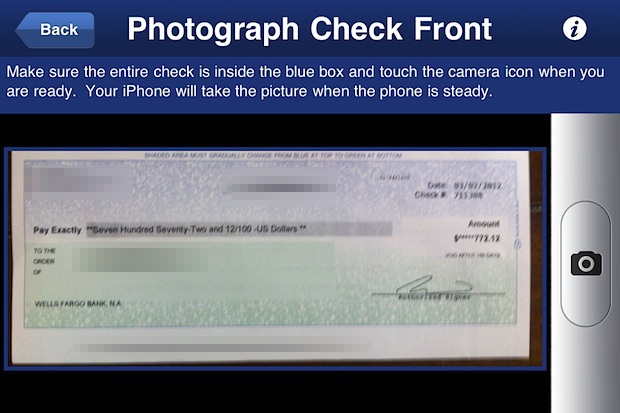

- Take a photo of the front and back of your endorsed check with your smartphone or tablet to deposit money directly into your checking account using our Wells Fargo Mobile ® app. 1 Learn more about.

- Chase and Wells Fargo requires that, if you want to deposit a check that is payable to two individuals, both payees must go to a branch in person and present government identification to verify.

- To cash or deposit a third-party check, you’ll need to show a current, government-issued photo ID. The verification requirements for the check’s payees vary from one bank to the next.

She was told to deposit $4,000 into the Wells Fargo account of the “car specialist.” She deposited the check and was able to withdraw $3,500 the next day, which she then deposited into the.

When you deposit a paper check, Wells Fargo must forward it to the bank on which it was written. There is a chance the check could be returned unpaid if the maker does not have enough money to cover the check. Wells Fargo uses information from the paying bank (where available) in determining when the money from the deposited check will be available to spend, and makes every effort to share the details with you when you are making the deposit.

When you deposit a paper check at a branch or an ATM, we credit the deposit to your account on that same business day if the deposit is made before the displayed cut-off time. Each check deposit is evaluated to determine if the bank can make all or a portion of your check immediately available for your use. There are a number of factors that determine whether a deposit receives immediate funds availability. Typically, any funds that are not made available to you immediately are credited to your account during our next nightly processing and available for your use the following day. We typically process transactions Monday through Friday, excluding holidays.

In some cases, all of the funds from a check deposit may not be available for several days. This is called a hold on your deposit. When a hold is placed, we may make $225 of the deposit available to you on the first business day and the remaining funds will be available when the hold expires.

Tip

How do I know when my money will be available?

Your deposit receipt provides the detail of when the funds will be available to you, including funds that are immediately available, available the next business day, or funds subject to a deposit hold. You can also use our convenient online, mobile and text banking tools to track your deposits and determine your available balance at any time.

If a hold is placed on a deposit, you will be notified of the hold either by the teller, by mail, email, at the ATM, or through mobile deposit.

Wells Fargo provides its funds availability schedule to all customers when they open an account. Also, you can request a copy of the schedule at any time in our banking locations.

Wells Fargo Check Deposit Online

Why would Wells Fargo place a hold on my deposit?

Occasionally, we may place a hold on a deposited check. Our decision to place a hold is frequently based on external information, for example if the paying bank notifies us that your deposited check will be returned unpaid or if you are re-depositing a check that was previously returned unpaid. A hold can also be based on information about your account, such as if an account was recently opened or has experienced frequent overdrafts and returned items.

Holds may seem like an inconvenience, but they actually are a way for us to help protect you from uncertainty and fraud. If a hold is not placed and a check is reversed, you may have already withdrawn all the money only to find that you are responsible for repaying the full amount of the returned check. We want to help you uncover any potential problems with a deposited check before you spend the money.

Wells Fargo will let you know as quickly as possible whether there will be a hold on a deposited check. If possible, the teller will notify you immediately at the time of deposit and your receipt will show how much of the deposit is being held and when the funds will be available to you. If the deposit is made through a Wells Fargo ATM or with our Wells Fargo Mobile Deposit, you will be informed during the deposit process if a hold will be placed or further review of the deposit is required. The ATM or mobile deposit receipt will display the amount held and when the funds will be available to you. If a hold is based upon information we learn after the deposit, Wells Fargo will notify you by mail, email or through the “Messages & Alerts” feature of Wells Fargo Online®.

Wells Fargo is committed to providing information that will help you use your accounts and services effectively. If you have any questions, feel free to visit a Personal Banker in any of our banking locations during normal business hours. Visit Wells Fargo Online at wellsfargo.com, or call us anytime at 1-800-TO-WELLS (1-800-869-3557).

Tip

Related topics:

Related topics: - Basic Finances,

Wells Fargo Check Deposit Atm

Empower yourself with financial knowledge

We’re committed to helping you with your financial success. Here you’ll find a wide range of helpful information, interactive tools, practical strategies, and more — all designed to help you increase your financial literacy and reach your financial goals.

Wells Fargo Check Deposit Policy

Products to Consider

Wells Fargo Check Deposit Max

Deposit products offered by Wells Fargo Bank, N.A. Member FDIC.